As we gear up for the June 30, 2025, trading session, all eyes are on the Nifty 50 and its critical 23,600 level. This zone has been a battleground lately, acting as both a support and a resistance point in recent sessions. With global markets showing signs of stability and domestic sentiment boosted by vigorous FII activity, Traders are on high alert. The big question: will Nifty hold steady at this level or dip lower? Let’s take a look at the nifty analysis for June 30, 2025

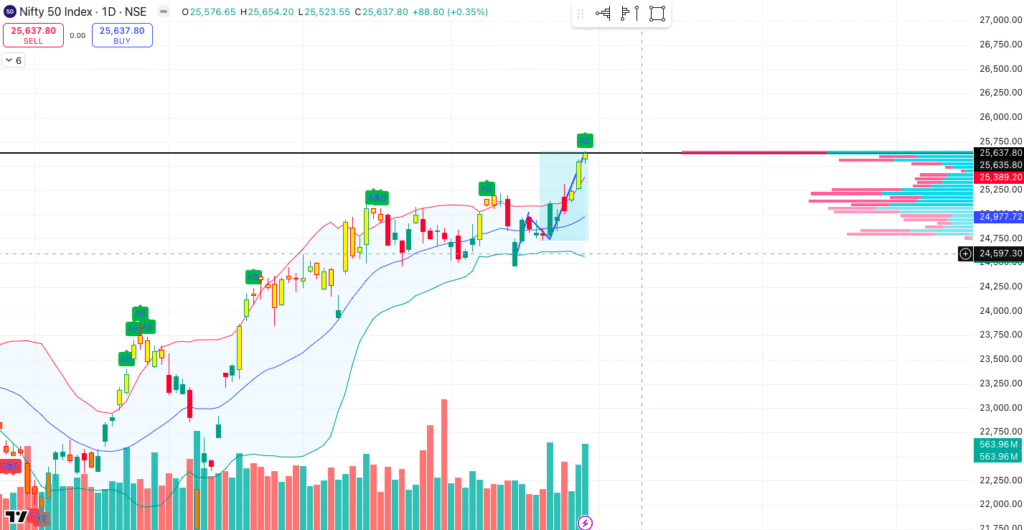

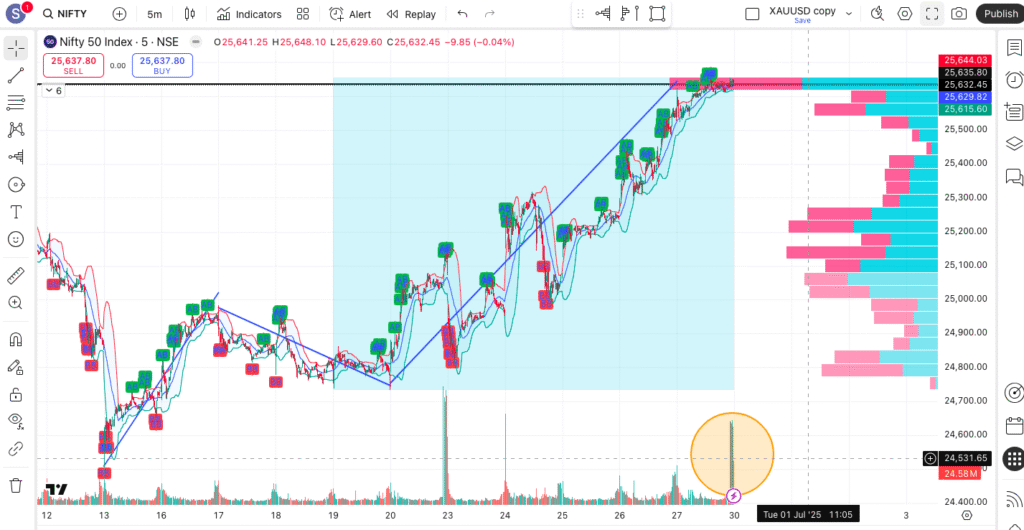

If we examine the last swing, we can see that the POC (point of control) is at its highest point, indicating significant activity at 25637. We can confirm this with volume when we examine the chart on a 5-minute time frame.

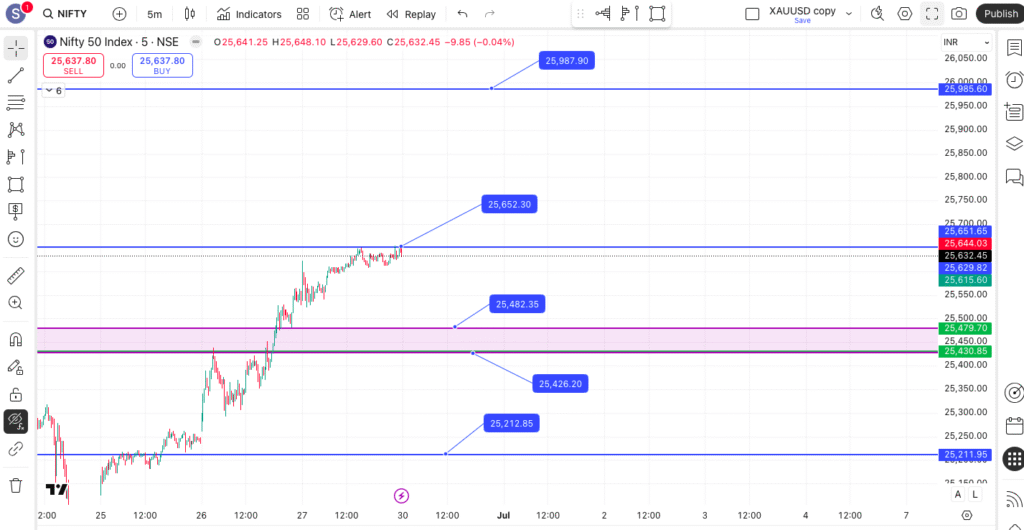

During closing time, there is a high volume (see the yellow-highlighted area on the 5-minute chart), and the Point of Control (POC) is located at the top. Therefore, if the price stays above 25637, we can expect a significant upward movement. Otherwise, it may test the 50 percent retracement of the last swing that will be at 25482.

Here are the key levels for Nifty as of June 30, 2025. I expect a significant gap up or gap down on Monday. If the market starts to decline, the support levels will be at 25483, then 25,426. The last support will be at 25212. In the above graph, you can see the important support and resistance levels. Get all the graphs in our Telegram channel.

Disclaimer: All content is for educational purposes only. This is not financial advice. Please consult a SEBI-registered advisor before making investment decisions.”